Retirement

UNC Charlotte offers several options to help you plan and save for your retirement — including a choice of mandatory retirement plans and a variety of supplemental retirement savings plans. We recommend that throughout your career, you periodically review your financial situation, establish and review retirement goals, and adjust supplementary retirement savings programs as necessary.

Important!

As of Sept. 1, 2023, the University moved to TIAA as the single recordkeeper for the UNC System retirement plans. More details about the transition can be found here.

Ready Set Go Presentations (pending 2026 updates)

- Retirement Ready, Set, Go! Part 1 (Healthcare Coverage, Supplemental Retirement, NCFlex, and Leave)

- Retirement Ready, Set, Go! Part 2 (Optional Retirement Plan)

- Retirement Ready, Set, Go! Part 3 (TSERS)

Mandatory Retirement Programs

Teachers’ and State Employees’ Retirement System (TSERS)

TSERS is a defined benefit plan — under this plan, the State controls the investment. The benefit you receive at retirement is based on a formula including your age, your average financial compensation and your years and months of creditable service. You as the employee contribute 6% to the plan and the University contributes an amount that is defined by the North Carolina General Assembly.

Optional Retirement Program (ORP)

ORP is a defined contribution plan — under this plan, you control your investments. The benefit you receive at retirement is based on the performance and payment option you choose. You, as the employee, contribute 6%, and the University contributes 6.84%.

Please note, benefits-eligible employees hired on or after Sept. 1, 2023, may only enroll in TIAA if they select the Optional Retirement Program.

Eligibility

Permanent, full-time employees working 30 or more hours a week are eligible for mandatory retirement plans.

Enrollment Deadline

Benefits-eligible employees hired after Sept. 1, 2023, have 30 days from their hire or newly eligible date to enroll.

Effective Date

First day of eligible employment.

Deduction Frequency

Semi-monthly each check of eligible earnings.

Supplemental Retirement Programs

If you want to increase your retirement savings, you can participate in one or more of the following supplemental retirement plans: UNC System 403(b) Plan, UNC System 457(b) Plan, State’s 401(k) Plan and State’s 457 (depending on eligibility).

Plan Options

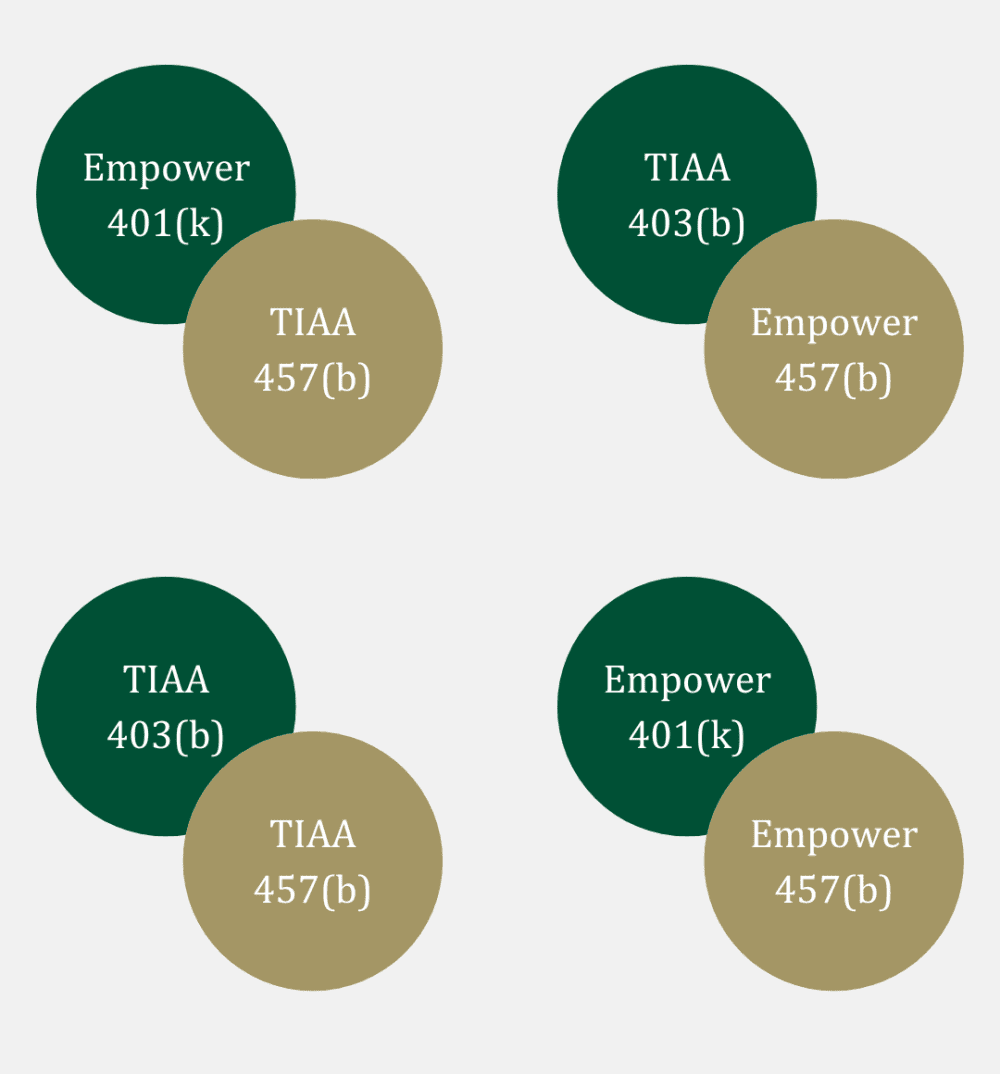

Eligible employees can choose to contribute to a pair of supplemental retirement plans, provided by TIAA and Empower, as outlined below:

- State 401(k) plan (Empower) and UNC System 457(b) plan (TIAA)

- State 401(k) plan (Empower) and State 457(b) plan (Empower)

- UNC System 403(b) plan (TIAA) and State 457(b) plan (Empower)

- UNC System 403(b) plan (TIAA) and UNC System 457(b) plan (TIAA)

Contribution Limits

| Description | Age Category | 2025 Limits | 2026 Limits |

| Standard Contributions | Under age 50 | $23,500 | $24,500 |

| Catch-up Contributions | Over age 50 | $7,500 | $8,000 |

| Super Catch-up Contributions | Age 60-63 (State 401k and 457 plans only) | $11,250 | $11,250 |

Effective Jan. 1, 2026, 401(k), 403(b) and 457(b) catch-up contributions for participants age 50 and older whose FICA wages from their current UNC constituent institution for the prior year (2025) met or exceeded $150,000 (Box 3 of the 2025 W-2) must be made on a Roth (after-tax) basis.

The 401(k) and 403(b) contributions are coordinated (combined total cannot exceed the maximum). However, reference the plan options section above for revised combinations of plans permitted, effective March 15, 2025.

The 457 contributions are not coordinated with the 401(k), nor 403(b) (total cannot exceed the maximum). As an alternative to the catch-up or super catch-up contributions, a participant in the State’s 457 plan is eligible to defer up to twice the contribution limit in effect for the three years preceding the employee’s normal retirement age, subject to eligibility. Contact the NC Total Retirement agent for more details.

Eligibility

| Plan | Eligibility |

| UNC System 403(b) Plan | Employees who pay FICA |

| UNC System 457(b) Plan | Employees who pay FICA |

| State’s 457 Deferred Compensation Plan |

|

| State’s 401(k) Plan | All North Carolina public employees |

Enrollment

You may enroll at any time. Information and forms on how to enroll in each plan can be found at the following links

- UNC System 403(b) (Vendor: TIAA)

- UNC System 457(b) (Vendor: TIAA)

- State’s NC 457 and 401(k) (Vendor: Empower)

Note for UNC System 403(b) and UNC System 457: Check with the vendor to ensure your account is established and ready to receive contributions before completing a salary reduction form for new enrollments.

Send completed forms to UNC Charlotte Benefits Office by fax: 704-687-5254, or mail: 9201 University City Boulevard, Room 207, King Building, Charlotte, NC 28223

Deduction Frequency

Semi-monthly, based on enrollment.

Processing Timeline:

Eligible employees may enroll, change, or cancel contributions for supplemental retirement plans at any time throughout the year, to be reflected in paychecks according to processing deadlines.

- Deadlines for the Benefits Office to receive hard copy forms, and/or online transactions are noted below:

- 1st day of the month to impact the last check of the month (except new enrollments for 457 plans)*

- 15th day of the month to impact the first check of the next month

- Exceptions:

- *Contributions for new 457 plan enrollments cannot start until the month after the election is made

- Contact the Benefits Office if you have special situations

Contacts

TIAA

Peter Kohn

Financial Consultant

704-988-1580

Peter.kohn@tiaa.org

Contact for: Optional Retirement Plan, UNC System 403(b) Plan, UNC System 457 Plan

NC Total Retirement

Sean Martin

NC Plans Retirement Plan Counselor

704-219-9431

Sean.martin@empower.com

Calendar link to schedule a virtual/phone consultation

Contact for: State’s 457(b) Plan and State’s 401(k) Plan

North Carolina Retirement System

North Carolina Retirement System

Phone support is available 8:30 a.m. – 4:30 p.m. Monday through Friday, with a lunch break from 11:30 a.m. to 12:30 p.m.

Don’t want to wait on hold? See the Phone/Web Options tab for the automated phone menu and other ways to quickly find the information you need!

TSERS

(919) 814-4590

Fax: (919) 855-5800

NC 401(k) and NC 457

1-866-NCPlans (1-866-627-5267)

Email

NC Retirement Systems: NC.Retirement@nctreasurer.com

ADDITIONAL RESOURCES:

- Planning for Retirement

- UNC System Retirement Website

- Social Security Administration – Important Changes

- NCFlex Continuation Options at Separation of Employment

- The PIER: Retirement News You Can Use

- Supplemental Retirement Decision Guide

- Retirement Rates and Limits

- Mandatory Plan Video

- Supplemental Plan Video