Fair Labor Standards Act

The Fair Labor Standards Act (FLSA) is a federal law regulated by the United States Department of Labor, Wage and Hour Division. FLSA affects employees in the private sector and in Federal, State and local governments, and covers five major areas:

- Employee Status

- Child Labor

- Minimum Wage

- Overtime Pay

- Record Keeping

Positions may be classified as FLSA nonexempt or FLSA exempt based on salary level, salary basis and job duties. The FLSA status of a position is determined by the human resources consultants in Compensation and Position Management.

FLSA-nonexempt employees are eligible for overtime compensation and are required to complete weekly time sheets in Kronos. FLSA Subject employees whose regular work schedule is forty hours per week may be eligible for overtime compensation in the form of compensatory time off at time and a half for all hours worked in excess of forty hours. In rare circumstances, some departments may pay overtime to FLSA Subject employees who are approved to work in excess of forty hours during the 168 consecutive hour period that constitutes the workweek.

FLSA-exempt employees are ineligible for overtime pay. FLSA-exempt employees (both SHRA and EHRA) are not entitled to hour-for-hour compensatory time for hours worked in excess of forty weekly.

The FLSA does not regulate:

- Vacation, holiday, severance or sick pay;

- Meal or rest periods;

- Premium pay for weekend or holiday work;

- Pay raises or fringe benefits;

- A discharge notice, reason for discharge or immediate payment of final wages to terminated employees; or

- The number of hours in a day or days in a week an employee may be required or scheduled to work (if the employee is at least 16 years old)

FLSA Status

Employers are required to analyze and determine the FLSA exemption status of each position. Positions are designated as either exempt or nonexempt based on salary level, salary basis and job duties performed. Nonexempt employees are eligible to earn overtime for all hours worked beyond forty hours in a work week. Exempt employees are not. Most University employees are designated as FLSA nonexempt. Employers are required to maintain time records for all nonexempt employees to ensure compliance with overtime provisions.

The Difference Between Exempt and Nonexempt

- Exempt

- Overtime ineligible

- Paid at least $684 a week or $35,568 a year (as of July 1, 2024)

- Meets one of the exemption job duties tests

- Paid on a fixed salary basis

- Nonexempt

- Overtime eligible

- Paid less than $684 a week or $35,568 a year (as of July 1, 2024)

- Does not meet any of the exemption job duties tests

- Paid an hourly or salary rate

Additional Considerations:

- FLSA does not require that nonexempt employees be paid hourly. A salaried employee can be designated as nonexempt and overtime eligible.

- A position’s job title, career band, or competency level does not determine exemption status.

- All positions (SHRA and EHRA) must be evaluated to determine FLSA status. Both position types can be designated as exempt or nonexempt.

Exemption Tests

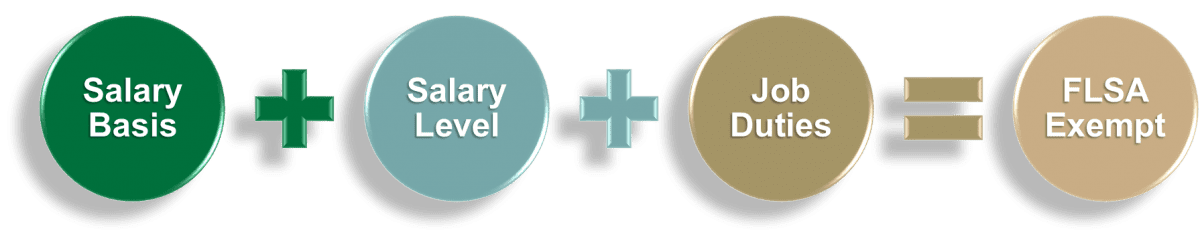

The salary basis, salary level, and job duties test must ALL be met in order for a position to be designated as FLSA exempt.

- Salary basis: guaranteed minimum amount of money that is not reduced based on quality or quantity of work

- Salary level: minimum of $684/week or $35,568/year (exceptions: teachers, doctors, and lawyers)

- Job duties: primary regular and recurring roles and responsibilities; consideration is not given to isolated, back-up, or one-time tasks

Exemption Categories

A position designated as FLSA exempt will perform job duties that fall into one or more of the following categories:

- Execuctive

- Management is the primary duty

- Has two or more full-time subpordinates

- Has the authority to hire and fire

- Examples: director, controller, VP

- Administrative

- Performs office or non-manual work

- Work is directly related to business operations

- Exercises discretion and independent judgement

- Examples: manager, supervisor, administrator

- Learned Professional

- Work requires advanced knowledge

- Work is in the fild of science or learning

- Requires prolonged, specialized instruction

- Examples: attorney, librarian, engineer

- Creative Professional

- Work requires invention, imagination, originality or talent

- Works in a field of artistic and creative endeavor

- Examples: musician, actor, painter, photographer

- Computer Related Professional

- Analyzes systems to determine hardware, software or system specs

- Designs, develops, analyzes, creates, tests or modifies systems or programs

- Examples: systems analyst, programmer or software engineer

- Highly Compensated Employee

- Performs office, non-manual, exempt work

- At least $107,432 total annual compensation

- Total compensation includes salary, commission and bonuses

- Examples: executive, brokers or sales

Considerations for Determining Exemption Category:

- Mere supervision of employees is not sufficient for an exemption

- Examples of business operations include: finance, human resources management, research, legal and regulatory compliance, public relations, auditing, and safety and health

- Discretion must be exercised related to matters of significance

- Independent judgment does not include repetitive or routine work, applying well-established techniques prescribed in manuals or clerical work

- Job duties evaluated are primary responsibilities performed on a regular and recurring basis; consideration is not given to back-up or one-time tasks

FLSA Exemption Checklists

Below are summaries of each FLSA exemption category. Managers should review this information to assess whether or not a position is likely to be exempt from overtime coverage. If a manager would like Human Resources to evaluate a position for an exemption, a checklist for the appropriate category must be completed and submitted as an attachment with a position request. Human Resources will evaluate the position description, FLSA checklist, organizational chart and any other necessary data to determine if both the salary and position duties meet the federal definition for an exemption.

Executive Exemption

Exempt executive employees generally are responsible for the success or failure of business operations under their management. Other critical elements are (1) whether management is the employee’s primary duty, (2) whether the employee directs the work of two or more full-time equivalent employees and (3) whether the employee has the authority to hire/fire other employees or, alternatively, whether the employee’s suggestions and recommendations as to the hiring, firing, advancement, promotion, or other change of status of other employees are given particular weight. Joint or shared supervision with another exempt employee is insufficient. Additionally, supervision in the regular manager’s absence is insufficient.

Administration Exemption

Exempt administrative employees are relatively high-level employees whose main job is to “keep the business running.” Exempt administrative job duties are (1) office or nonmanual work, which is (2) directly related to the management or general business operations of the employer or employer’s customers, and (3) a primary component of that involved the exercise of independent judgment and discretion about (4) matters of significance. In dependent judgment and discretion involves the comparison and evaluation of possible courses of conduct and having the authority to make an independent choice, free from immediate direction, with respect to matters of significance. It does not include the use of manuals, guidelines, or software packages to make determinations.

Learned Professional Exemption

The professional exemption encompasses two exceptions: one for learned professionals and one for creative professionals.

To be an exempt learned professional an employee must have a primary duty that is the performance of work requiring knowledge of an advanced type, including the consistent exercise of discretion and independent judgment, in a field of science or learning where the advanced knowledge is acquired by prolonged course of specialized intellectual instruction. Examples include lawyers, doctors, engineers, accountants, architects, librarians, nurses and scientists.

Creative Professional Exemption

The professional exemption encompasses two exceptions: one for learned professionals and one for creative professionals.

To meet the test for the creative professional exemption, an employee must have a primary duty that involves the performance of work requiring invention, imagination, originality or talent in a recognized field or artistic or creative endeavor. Examples include actors, performing artists, musicians, graphic arts and playwrights.

Computer Exemption

To qualify as an exempt computer employee, the employee must be employed as a systems analyst, computer programmer, software engineer or in a computer position requiring similar skills. The primary duty must consist of one or more of the following: (1) the application of systems analysis techniques and procedures, including consulting with users to determine hardware, software, or system functional specifications; (2) the design, development, documentation, analysis, creation, testing or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications; (3) the design, documentation, testing, creation or modification of computer programs related to machine operating systems. Job titles do not determine exempt status. In order for this exemption to apply, an employee’s specific job duties and compensation must meet all requirements of this exemption.

Record Keeping

Documentation Required by FLSA:

In order to ensure compliance, accurate records must be maintained for all nonexempt employees. Managers must be sure that all compensable time is tracked. The FLSA requires documentation of the following information:

- Time and day when the work week begins

- Hours worked each day

- Total hours worked each week

- Basis on which wages are paid

- Regular hourly pay rate

- Total daily or weekly straight time earnings

- Total overtime earnings

- Additions or deductions from wages

- Total wages paid each pay period

- Date of payment and pay period covered by payment

Kronos:

UNC Charlotte has implemented Kronos Workforce Ready as the time and leave reporting system of record for leave-earning employees. This program offers university employees an efficient, effective tool for tracking and reporting key employee data regarding time and leave. This system consistently tracks and monitors time worked and provides consistent application of FLSA rules. Kronos decrease our risk of FLSA noncompliance and increases accuracy of our timekeeping records.

References

- Normal and Variable Schedules for SHRA Staff Employees

- Completing and Retaining Employee Weekly Time Records for FLSA Nonexempt Employees

- Office of State Human Resources Hours of Work and Overtime Compensation Manual

- Accounting for Annual Leave for FLSA Exempt Employees

- Department of Labor FLSA Guidance