Supplemental Retirement Changes

Employees have the option to participate in four supplemental retirement plans: the UNC System 403(b) Plan and the UNC System 457(b) provided by TIAA, as well as the State 457 and the State 401(k) Plan provided by Empower.

Due to changes in federal law and to ensure compliance with IRS contribution limits, University employees are no longer permitted to split their contributions between the two carriers (TIAA and Empower) in certain instances.

The following will need your attention, as applicable:

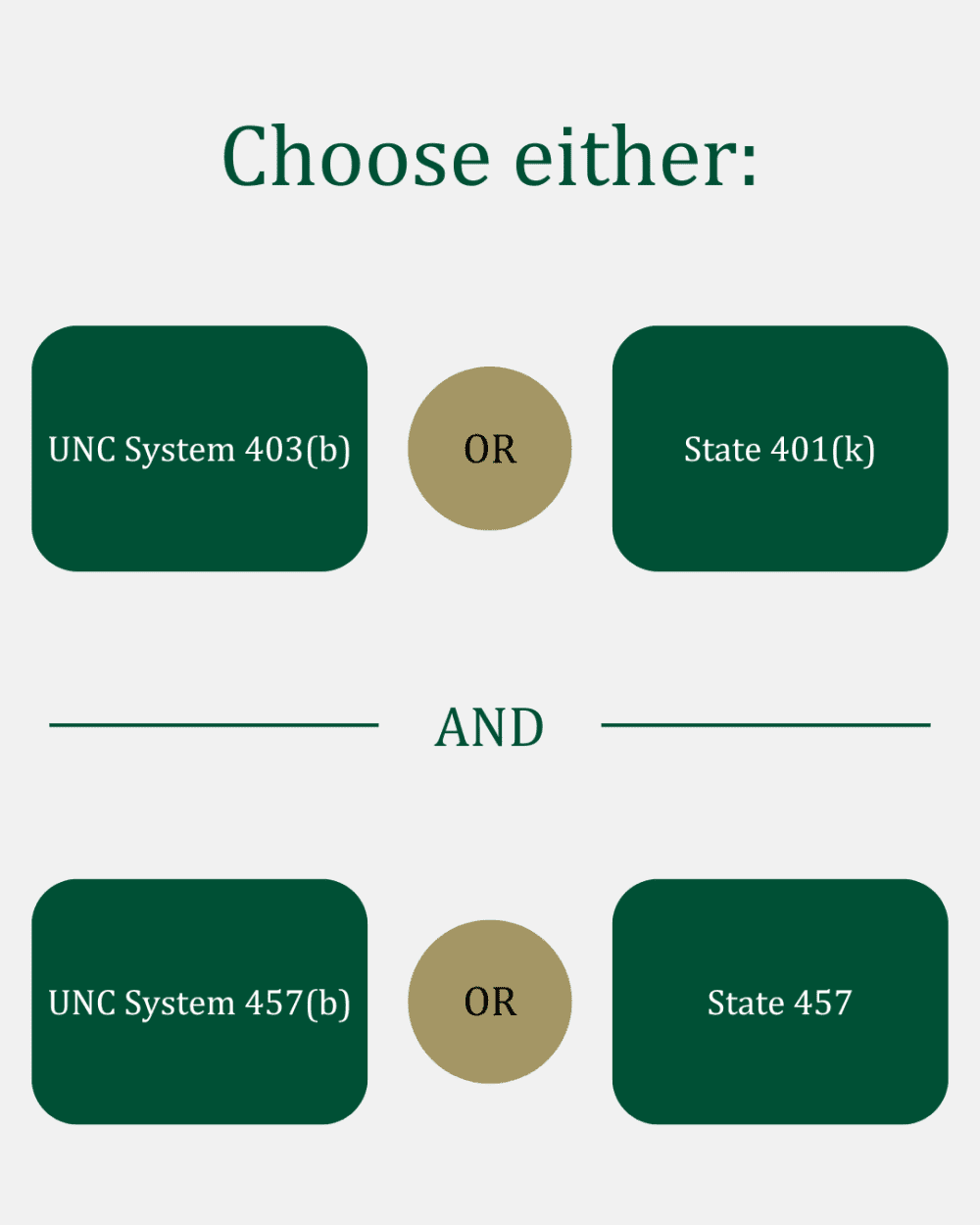

- UNC 403(b) & State 401(k) Plans: If you are currently contributing to both the UNC System 403(b) Plan (TIAA) and the State 401(k) Plan (Empower), you must select one plan.

- To select the UNC 403(b) Plan, complete a new 403(b) Salary Reduction Agreement Form

- To select the State 401(k) plan, complete a new NC 401(k) Enrollment Form.

- UNC 457(b) & State 457(b) Deferred Compensation Plans: If you are contributing to both the UNC 457(b) Plan and the State’s 457(b), you must select one plan.

- To select the UNC 457(b) Plan, complete a new 457(b) Voluntary Salary Deferral Agreement Form.

- To select the State 457(b) Plan, complete a new NC 457 Enrollment Form.

- Effective Date: For all existing employees splitting their contributions between various supplemental plans, all contributions must be directed to a single plan, as outlined above. Forms need to be emailed to Gina Ewart (giewart@charlotte.edu.) by Feb. 28, to allow processing for the March 14 paycheck. After this date, any employee who has not completed a new form will have their deductions suspended until a new election is made.

Note: This change only impacts future pre-tax and Roth after-tax deferrals. Your existing balances, even if allocated across both carriers, are unaffected.

Summary: If you are contributing to both the UNC 403(b) AND the State 401(k) Plans, you must choose one plan and complete a new agreement. Additionally, if you are contributing to the UNC 457(b) AND the State 457(b) Plans, you must choose one plan and complete the appropriate form. This must be completed by the deadline noted to avoid suspended deductions.

What is still allowed?

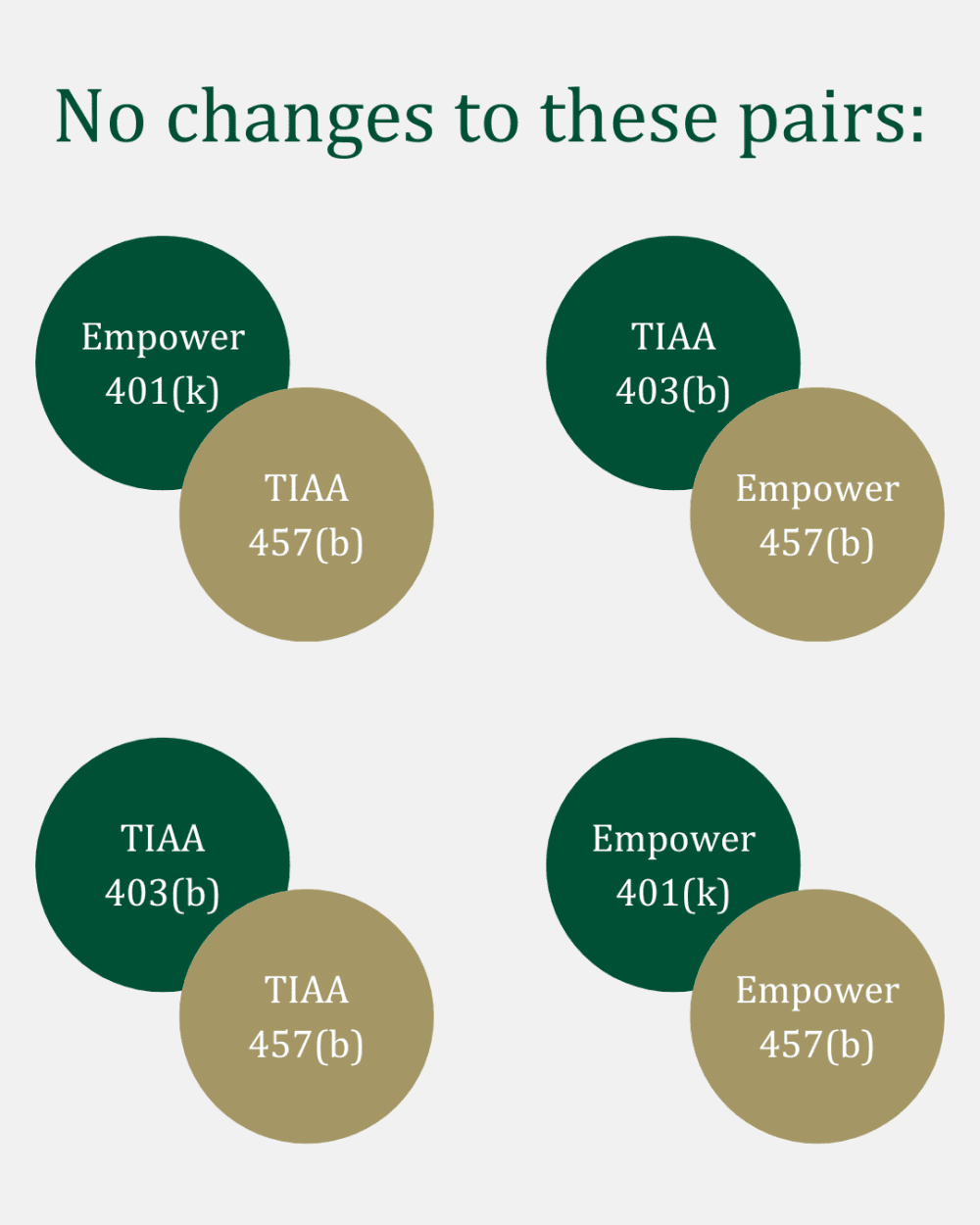

Employees can contribute to the combinations of supplemental retirement plans, provided by TIAA and Empower, only as outlined below.

- State 401(k) plan (Empower) and State 457(b) plan (Empower)

- State 401(k) plan (Empower) and UNC System 457(b) plan (TIAA)

- UNC System 403(b) plan (TIAA) and State 457(b) plan (Empower)

- UNC System 403(b) plan (TIAA) and UNC System 457(b) plan (TIAA)

No changes or additional forms are required for these contributions.

Note: This is not applicable to the law enforcement officers’ 401(k) 5%, which is mandatory, and paid by the employer

Please take action accordingly. If you have questions, or need additional information, please contact Gina Ewart at giewart@charlotte.edu.